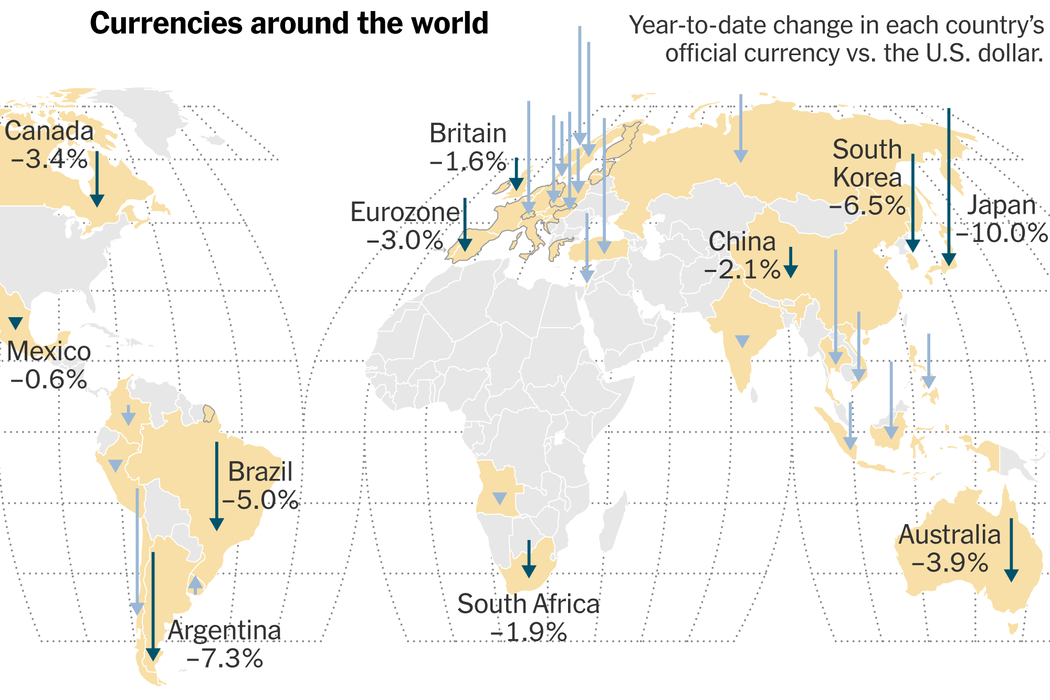

Every major currency in the world has fallen against the U.S. dollar this year, an unusually broad shift with the potential for serious consequences across the global economy.

全世界所有主要货币今年都输给了美元,这一不同寻常的广泛转变,可能给全球经济带来严重的后果。

Two-thirds of the roughly 150 currencies tracked by Bloomberg have weakened against the dollar, whose recent strength stems from a shift in expectations about when and by how much the Federal Reserve may cut its benchmark interest rate, which sits around a 20-year high.

在彭博公司跟踪的约150种货币中,有三分之二相对美元贬值,后者近期的走强,是源于对美联储降息时间和幅度的预期出现了转变,目前其基准利率处于20年来最高水平。

High Fed rates, a response to stubborn inflation, mean that American assets offer better returns than much of the world, and investors need dollars to buy them. In recent months, money has flowed into the United States with a force that’s being felt by policymakers, politicians and people from Brussels to Beijing, Toronto to Tokyo.

为应对久久不退的通胀而保持高位的利率,意味着美国资产的回报率会优于全世界大多数地方,而投资者需要用美元购买美国资产。从布鲁塞尔到北京,从多伦多到东京,世界各地的政界和其他领域人士近几个月都感受到了资金流向美国的猛烈势头。

The dollar index, a common way to gauge the general strength of the U.S. currency against a basket of its major trading partners, is hovering at levels last seen in the early 2000s (when U.S. interest rates were also similarly high).

美元指数通常用于估量美元相对一揽子主要贸易伙伴总体强弱,如今该指数正处在自21世纪初以来的最高水平(上一次在如此高位,美国的利率也处于类似的高水平)。

The yen is at a 34-year low against the U.S. dollar. The euro and Canadian dollar are sagging. The Chinese yuan has shown notable signs of weakness, despite officials’ stated intent to stabilize it.

日元兑美元正处于34年来的最低。欧元和加拿大元走势萎靡。人民币显露明显的颓势,尽管官员表示打算出手稳定币值。

“It has never been truer that the Fed is the world’s central bank,” said Jesse Rogers, an economist at Moody’s Analytics.

“联储是世界的央行,这一点从未如此真切,”穆迪分析的经济学家杰西·罗杰斯说。

When the dollar strengthens, the effects can be fast and far-reaching.

美元的坚挺会带来快速而广泛的影响。

The dollar is on one side of nearly 90 percent of all foreign exchange transactions. A strengthening U.S. currency intensifies inflation abroad, as countries need to swap more of their own currencies for the same amount of dollar-denominated goods, which includes imports from the United States as well as globally traded commodities, like oil, often priced in dollars. Countries that have borrowed in dollars also face higher interest bills.

在所有的外币交易中,涉及到美元的占了近九成。美元坚挺会加剧其他国家的通胀,因为这些国家在购买同等量以美元计价的商品时需要付出更多本国的货币,这包括了从美国进口商品,以及像石油这样通常以美元计价的全球交易大宗商品。有美元债务的国家还会面临更高的利息账单。

There can be benefits for some foreign businesses, however. A strong dollar benefits exporters that sell to the United States, as Americans can afford to buy more foreign goods and services (including cheaper vacations). That puts American companies that sell abroad at a disadvantage, since their goods appear more expensive, and could widen the U.S. trade deficit at a time when President Biden is promoting more domestic industry.

不过某些外国经营项目可能会受益。美元坚挺对向美国出口的商人有利,因为这让美国人可以购买更多的商品和服务(包括外出度假也会更便宜)。而美国的出口商则处于不利,因为它们的商品会显得更昂贵,从而进一步扩大美国的贸易逆差,尽管拜登总统此时正在寻求促进本国的产业。

Exactly how these positives and negatives shake out depends on why the dollar is stronger, and that depends on the reason U.S. interests rates might remain high.

这些利弊最终会带来怎样的变化,取决于为什么美元在升值,也取决于为什么美国的利率至今仍保持在高位。

Earlier in the year, unexpectedly strong U.S. growth, which can lift the global economy, had begun to outweigh worries over stubborn inflation. But if U.S. rates remain high because inflation is sticky even as economic growth slows, then the effects could be more “sinister,” said Kamakshya Trivedi, an analyst at Goldman Sachs.

今年早些时候,美国实现高于预期的增长——有望提振全球经济——这一点渐渐盖过了对顽固通胀的担忧。然而高盛分析师卡马克什亚·特里维迪说,如果美国由于通胀不退而保持高利率,即便经济增长放缓也不降息,那么就可能造成更“凶险”的影响了。

In that case, policymakers would be stuck between supporting their domestic economies by cutting rates or supporting their currency by keeping them high. “We are at the cusp of that,” Mr. Trivedi said.

那样的话,政策制定者就会处于两难境地,是降息支撑本土经济,还是保持高利率以支持本国货币价值。“我们正处在这样一个关口上,”特里维迪说。

The strong dollar’s effects have been felt particularly sharply in Asia. This month, the finance ministers of Japan, South Korea and the United States met in Washington, and among other things they pledged to “consult closely on foreign exchange market developments.” Their post-meeting statement also noted the “serious concerns of Japan and the Republic of Korea about the recent sharp depreciation of the Japanese yen and the Korean won.”

坚挺的美元给亚洲的影响格外剧烈。日本、韩国和美国财长本月在华盛顿会面,做出了一系列的表态,包括“就外汇市场动向展开更紧密的会商”。他们的会后声明也提到“日本和韩国严重关切近期日元与韩元的大幅贬值”。

The Korean won is the weakest it has been since 2022, and the country’s central bank governor recently called moves in the currency market “excessive.”

韩元处于2022年以来的最低位,该国央行行长最近称货币市场的走向“过头了”。

The yen has been tumbling against the dollar, and on Monday briefly slipped past 160 yen to the dollar for the first time since 1990. In sharp contrast to the Fed in the United States, Japan’s central bank began raising interest rates only this year after struggling for decades with low growth.

日元也在相对美元剧烈贬值,周一一度跌破1美元兑160日元,为1990年以来的首次。与美联储截然不同的是,日本央行在经历了数十年的低增长煎熬后,直到今年才开始提升利率。

For Japanese officials, that means striking a delicate balance — increase rates, but not by too much in a way that could stifle growth. The consequence of that balancing act is a weakened currency, as rates have stayed near zero. The risk is that if the yen continues to weaken, investors and consumers may lose confidence in the Japanese economy, shifting more of their money abroad.

对日本官员来说,这意味着需要保持一个微妙的平衡——要升息,但又不能升太多以至于抑制增长。这种权衡的结果就是日元贬值,因为利率仍然处在接近零的水平。风险在于如果日元继续疲软,投资者和消费者会对日本经济失去信心,从而将更多的钱转往国外。

In Europe, policymakers at the European Central Bank have signaled that they could cut rates at their next meeting, in June. But even with inflation improving in the eurozone, there is a concern among some that by lowering interest rates before the Fed, the difference in interest rates between the eurozone and the United States would widen, further weakening the euro.

在欧洲,欧洲央行的政策制定者们已经表示,他们可能会在下一次会面时降息,也就是在6月。然而,尽管欧元区的通胀在缓解,一些人还是担心,如果先于美联储降低利率,欧元区和美国的利率差扩大,会导致欧元的进一步疲软。

Gabriel Makhlouf, governor of Ireland’s central bank and one of the 26 members of the E.C.B.’s governing council, said that when setting policy, “we can’t ignore what’s happening in the U.S.”

爱尔兰央行行长、欧洲央行管理委员会26位成员之一加布里埃尔·马赫卢夫说,在制定政策时,“我们不能无视在美国正发生的情况。”

Other policymakers are confronting similar complications, with central banks in South Korea and Thailand among those also considering lowering interest rates.

还有一些政策制定者也面临类似的复杂局面,韩国和泰国的央行也在考虑要不要降息。

By contrast, Indonesia’s central bank unexpectedly raised rates last week, in part to support the country’s depreciating currency, a sign of how the dollar’s strength is reverberating around the world in different ways. Some of the fastest-falling currencies this year, like those in Egypt, Lebanon and Nigeria, reflect domestic challenges made even more daunting by the pressure exerted by a stronger dollar.

相比之下,印度尼西亚央行上周意外地宣布提升利率,一定程度上是为了支撑正在贬值的本国货币,从中可以看到美元的坚挺在世界各地产生的影响是不一样的。今年贬值最严重的货币,比如埃及、黎巴嫩和尼日利亚,反映出美元走强造成的压力会导致国内的挑战变得格外严峻。

“We are on the edge of a storm,” Mr. Rogers of Moody’s said.

“我们正处在一场风暴的边缘,”穆迪的罗杰斯说。

(本新闻网址:https://www.geilien.cn/news/2024/nysdollar.html)

Eshe Nelson对本文有报道贡献。

Joe Rennison撰写关于金融市场的报道,包括记录股市的变幻无常、解释华尔街内部人士经常难以捉摸的交易决定等。

翻译:杜然